Introduction

Ala-ud-din Khilji, whose original name was Ali Gurshasp, was the second ruler of the Khilji dynasty. He was one of the most successful rulers of the Delhi Sultanate. Among the rulers of the medieval India, Ala-ud-din occupies an honourable position both as a conqueror and administrator. He was the greatest ruler of the Khilji dynasty and successfully repelled several invasions from the Mongol Empire. Ala-ud-din was the nephew and son-in-law of Jalal-ud-din. Ala-ud-din was appointed as governor of Kara by his uncle. He killed his uncle and proclaimed himself as King of Delhi on 3rd October 1296.

Ala-ud-din Khilji, whose original name was Ali Gurshasp, was the second ruler of the Khilji dynasty. He was one of the most successful rulers of the Delhi Sultanate. Among the rulers of the medieval India, Ala-ud-din occupies an honourable position both as a conqueror and administrator. He was the greatest ruler of the Khilji dynasty and successfully repelled several invasions from the Mongol Empire. Ala-ud-din was the nephew and son-in-law of Jalal-ud-din. Ala-ud-din was appointed as governor of Kara by his uncle. He killed his uncle and proclaimed himself as King of Delhi on 3rd October 1296.

Empire of Ala-ud-din Khilji

Ala-ud-din Khilji succeeded in conquering most parts of India. Larger portion of north India was annexed to his empire. He also defeated many rulers in south India except the Pandyas, who were forced to accept his suzerainty. The places in north India which were incorporated within his empire were Gujarat, Jaisalmer, Ranthambhor, Chittor, Malwa, Siwana, and Jalore. The kingdoms in south India that were under his dominion were the Hoysala kingdom and the kingdom of Devagari.

Ala-ud-din Khilji succeeded in conquering most parts of India. Larger portion of north India was annexed to his empire. He also defeated many rulers in south India except the Pandyas, who were forced to accept his suzerainty. The places in north India which were incorporated within his empire were Gujarat, Jaisalmer, Ranthambhor, Chittor, Malwa, Siwana, and Jalore. The kingdoms in south India that were under his dominion were the Hoysala kingdom and the kingdom of Devagari.

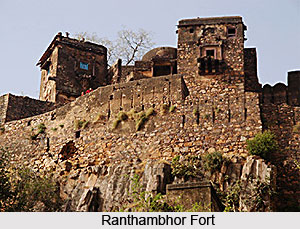

Gujarat was a prosperous state and in the latter half of 1298 A.D. Ala-ud-din Khilji sent an expedition under Ulugh Khan and Nusrat Khan to Gujarat. On the way, Jaisalmer was also conquered. At that time Karna was the ruler of Gujarat who was defeated by the army of Ala-ud-din. Ranthambhor was a stronghold of Chauhana Rajputs. Ala-ud-din wanted to conquer it because of its strategical importance. He dispatched Ulugh Khan and Nusrat Khan to attack Ranthambhor. Though the fort was besieged but Nusrat Khan was killed in the combat and the invaders were forced to retreat. Then Ala-ud-din himself besieged the fort. It took one long year for Ala-ud-din to successfully capture the fort.

Chittor was another centre for the powers of the Rajputs. The fort of Chittor was constructed on a high hill and was regarded as unconquerable. Ala-ud-din attacked Chittor in 1303 A.D. and besieged the fort. A part of Malwa was already in the hands of the Sultan but it was never completely conquered. Ala-ud-din sent Ain -ul -mulk, governor of Multan, to attack Malwa, who besieged the fort of Mandu. Siwana was attacked in 1308 A.D. by Ala-ud-din and was eventually captured. The conquest of Jalor completed the conquest of Rajasthan by Ala-ud-din Khilji. Bundi, Mandor, Tonk and probably Jodhpur also surrendered to Ala-ud-din. All the strong forts of Rajasthan were captured by him and that provided safety to the passages towards Gujarat and South India.

In the beginning of the 14th century Ala-ud-din decided to conquer the south India. The purpose of Ala-ud-din in attacking the kingdoms of south India was two fold. The south was not plundered so far by Muslim invaders and therefore possessed vast wealth and therefore he wanted to plunder the resources of south India. His other aim was to force them to accept his suzerainty and get annual tribute from them which would be a regular source of wealth for him and would also increase his prestige in India.

Ala-ud-din sent Malik Kafur to attack Telangana in 1309 A.D. he conquered Sirbar on the way and reached the capital city of Warangal in 1310 A.D. the capital was well defended by two round walls, the outer one being that of earth and the inner one that of stone and also by two moats filled with water between the two walls. The ruler of Telengana accepted the suzerainty of Ala-ud-din and agreed to pay annual tribute and gave one hundred elephants, seven hundred horses and all his accumulated treasure as gift. Vir Ballala of the Hoysala Empire also agreed for peace with Ala-ud-din and agreed to pay annual tribute.

Ala-ud-din`s policy towards the south was successful. He succeeded in fulfilling his object. Ala-ud-din was the first Muslim Sultan of Delhi who dared to attack south India and was successful. Most of the kingdoms of the south were forced to accept his suzerainty and pat annual tribute to him.

Thus Ala-ud-din Khilji succeeded in establishing a vast empire in India. Towards the North West it extended up to the Indus River and after 1306 A.D. even Kabul and Ghazni came under his sphere of influence. Towards the east it extended up to Avadh and Orissa. Punjab in the north to the Vindhyas in the south, all territories formed part of his empire. In the south except the Pandya ruler, all of them accepted his supremacy. The empire of Ala-ud-din Khilji was certainly more extensive as compared to all other previous Muslim rulers of Delhi.

Reign of Ala-ud-din Khilji

He ruled for a span of 20 years from the year 1296-1316. He went on to vandalise the wealth of nobles, looting temples and invaded many states. He defeated the nobles and made them completely submissive to the crown. He was ambitious and dreamt of ruling over the whole of Indian empire. Ala-ud-din`s talents were engaged in seeking fulfilment in worldly possession and power. In 1292 AD, Ala-ud-din successfully attacked Bhilsa and was awarded the governorship of Awadh. In the year 1296 he got enormous booty from Devagiri which further raise his prestige and the number of his followers. He defeated the ruler of Devagiri and forced them to pay a huge war indemnity. This helped him in capturing the throne of Delhi.

Policy of Ala ud din Khilji

Ala -ud -din was not tolerant towards the Hindus. While conquering different states in the North, Ala -ud -din had looted many Hindu homes. Especially on his way back from Jalandhar he had sacked and damaged many Hindu temples. Cows were butchered and Hindu women raped. Local Hindus were made to accept Islam; such atrocities were going on since a long time. As Ulugh Khan and Nusrat Khan turned back toward Delhi, their armies laden with fabulous loot, a serious revolt broke out in their ranks. The ones who revolted were killed, disfigured and captured. The prisoners retaliated with the help of Muslim soldiers. A large number of Hindu captives were successful in escaping. Even in matters of revenue and taxation, the Hindus had to pay more than the Muslims. While Muslim merchants paid only five percent of the value of their merchandise as tax, Hindu merchants were asked to pay ten percent.

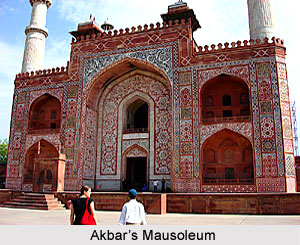

Ala -ud -din was an ambitious ruler but a practical statesman as well. He accepted the limitations of his ambition. He did not annex the territories of the vanquished rulers of the south because he could realise that it was difficult to keep under control the states of the south from such a distant place as Delhi. He could be diplomatic and conspiring at one time and chivalrous at other times. He changed his course of action according to circumstances and that was one of the most important reasons of his success practically in all fields. As an individual, Ala -ud -din was a follower of Islam and respected religious people. Though he himself was illiterate, he was a patron of fine arts and learning. Most of the known scholars of his age were assembled at his court. Amir Khusrau and Amir Hasan of Delhi were patronised by him. Ala -ud -din also constructed many good buildings including the fort of Siri, palace of one thousand pillars called Hazar Situn and several mosques, tanks and rest houses. His Alai Darwaza, has been regarded as one of the best specimens of early Turkish architecture.

Ala -ud -din occupies an important position among the rulers of medieval India. He became Sultan at the age of thirty and within a span of fifteen years he became the most powerful rulers of India. The success which Ala -ud -din achieved during his lifetime was unique both regarding the extension of the empire and the administration. Ala -ud -din was a brave soldier, a most capable military commander, a shrewd diplomat, a great conqueror, a successful administrator and a powerful and ambitious Sultan. His primary object was to achieve success and he gained it in practically all fields although his life.

Economic Policy of Ala ud din Khilji

Ala-ud-din Khilji adopted several economic policies to maintain a steady market system. Though the treasury of the Sultan was full but it was necessary to regulate the prices of the goods for the interests of the subjects. Ala-ud-din kept a large standing army at the centre and paid it in cash. Therefore, his expenses on the army were enormous. Ala-ud-din had distributed wealth lavishly among his subjects which reduced the value of the currency in the market. Thus, it became necessary for Ala-ud-din to reduce the salary of his soldiers and also to reduce the cost of the articles in the market. Ala -ud -din`s motive was to check the rising prices which were due to manipulation of the business community and not to reduce the prices to a lower level than the normal. The necessity of his market-policy arose also because of the necessity of keeping a huge standing army and paying it in cash.

Ala-ud-din Khilji adopted several economic policies to maintain a steady market system. Though the treasury of the Sultan was full but it was necessary to regulate the prices of the goods for the interests of the subjects. Ala-ud-din kept a large standing army at the centre and paid it in cash. Therefore, his expenses on the army were enormous. Ala-ud-din had distributed wealth lavishly among his subjects which reduced the value of the currency in the market. Thus, it became necessary for Ala-ud-din to reduce the salary of his soldiers and also to reduce the cost of the articles in the market. Ala -ud -din`s motive was to check the rising prices which were due to manipulation of the business community and not to reduce the prices to a lower level than the normal. The necessity of his market-policy arose also because of the necessity of keeping a huge standing army and paying it in cash.

Some historians have pointed out that the cause of this economic policy was humanitarian. Ala-ud-din desired that all his subjects should get necessary articles in sufficient quantity and at proper prices. While according to many scholars, the primary object of Ala-ud-din in enforcing these measures was purely political. He kept a permanent standing army at the centre and paid it in cash but desired that the soldiers remain comfortable with reasonable amount of salary. Therefore, he tried to check the inflationary prices, and the exploitation of merchants to raise the prices falsely and, thereby, was forced to fix the prices of articles and impose them sternly.

Ala-ud-din fixed up the prices of nearly all articles. The prices were fixed not only of all varieties of grain, pulses, cloth, slaves, cattle and horses only but even those of essential articles of every day use as that of meat, fish, dry fruits, sugarcane, vegetable, needles, colours, betel-leaves etc. Separate markets were fixed up for different articles. Ala-ud-din established go downs where grain was stored in reserve to be released in times of scarcity. In times of need everything was rationed i.e. everybody was allowed to purchase only that much which was just adequate for his need. Thus, arrangements were so made that the people might not feel insufficiency of anything anytime. That is why revenue was collected in kind both from Khalisa land and the lands of feudatory chiefs. Only those traders who were registered with the state were allowed to purchase grain from the peasants. All merchants were required to register themselves at the office of Shahna-i-mandi. All merchants were forced to bring at least some fixed minimum quantity of different articles to capital so that there was no scarcity of anything.

Everything was sold at fixed rates and even the highest officer of the Sultan was not allowed to alter the rate or price of any article without prior permission of the Sultan. Nobody could dare to sell any commodity underweight as the same amount flesh was cut off from his body. No peasant or merchant could hoard any commodity. Speculation and black-marketing was totally stopped. All these regulations were strictly enforced and the guilty ones were harshly punished. The economic policy of Ala-ud-din was enforced only in Delhi and its nearby areas.

Ala-ud-din was successful in fulfilling his object during his lifetime. He wanted to keep an enormous permanent standing army at the centre and for that purpose he fixed the prices of all commodities. He succeeded in his effort. He maintained a strong army at the centre which successfully repulsed invasions of the Mongols and successfully conquered practically the whole of India for him and his enforcement of price fixation of all commodities was also fully successful.

Revenue System of Ala ud din Khilji

Ala -ud -din Khilji implemented a number of revenue and taxation measures which aimed at establishing an authoritative and despotic state. In order to manifest his desire to extend his empire, it was necessary to increase the income of the state. Other factors were also responsible for bringing about a change in the existing financial and revenue structure of the state.

Ala -ud -din Khilji implemented a number of revenue and taxation measures which aimed at establishing an authoritative and despotic state. In order to manifest his desire to extend his empire, it was necessary to increase the income of the state. Other factors were also responsible for bringing about a change in the existing financial and revenue structure of the state.

Ala -ud -din Khilji`s position was threatened by the revolts of the Hindus while the Mongols were posing danger to his empire. Thus a requirement of a well equipped large army was necessary. There are also other reasons which determined the financial policy, for instance, the class which worked as middleman between the state and the peasants enjoyed best advantages. This class had increased its landed property without the consent of the State and, while it collected maximum revenue from the peasants, it paid the minimum to the state. Thus this class enjoyed best advantages at the cost of the state. By implementing various financial policy Ala -ud -din wanted to break up their power and influences on people.

Ala -ud -din Khilji ordered confiscation of all those lands which were given to the people by previous rulers as milk (state srant), inam (state gift), waqf (charitable endowment) and pension in return of state service. He confiscated lands of those people who were not serving the state in any form and again redistributed it among those who were doing helpful service to the state. A complete record was maintained regarding who was assigned how much land and of what quality. This measure of Ala-ud -din Khilji increased the Khalisa-land (state land), left the possession of land in the hands of competent and useful persons and diminished authority of the old nobility.

One of the revenue measures of Ala-ud-din attacked the privileged position of hereditary revenue officers like Khuts, Chaudhris and Muqaddams who were all Hindus. It was alleged that they collected maximum revenue from the peasants but appropriated to themselves as much of it as they could. They escaped payment of taxes like Khiraj, Jizya, Ghari and Charai. Therefore, they had become rich and affluent. Ala-ud-din abolished their privileges and snatched away their right to collect revenues. They were asked to pay revenue and all other taxes and thus, there remained no distinction between the Khuts (zamindars) and the Balahars (ordinary peasants). By this policy Ala-ud-din broke up the power of the Hindus to rise in revolt.

Ala-ud-din raised the revenue demand to one-half of the gross produce. The land revenue was to be assessed by the technique of measurement on the basis of standard yields. Ala-ud-din was the first Muslim ruler who introduced this system which certainly marked a progress upon the customary sharing system. The Sultan preferred to collect the revenue in kind instead of cash. Ala-ud-din also imposed two new taxes. The one was grazing tax on all milch cattle and the other was the house-tax. Taxes like jizya and irrigation tax and import and export duties remained as usual.

The system of Ala-ud-din imposed heavy burden on the peasantry. The peasants had to pay seventy five percent of their income to the state as taxes. While Muslim merchants paid only five percent of the value of their merchandise as tax, Hindu merchants were asked to pay ten percent. This revenue system of Ala-ud-din could not be implemented universally within the entire imperial territory. The collection of revenue by state officers after measurement of land was done only in Delhi and its nearby territories. This system was not introduced in lower Doab, Awadh, Gorakhpt, Bihar, Bengal, Malwa, West Punjab, Gujarat and Sindh.

Ala-ud-din established a new department known as Diwani -i- Mustakhraj to look after his revenue administration. He also engaged a large number of junior and senior officers for the same purpose. He raised the salaries of revenue officers so that they might become free from temptation of bribery. Though, it was not possible to root out corruption and dishonesty from the revenue department, yet Ala-ud-din succeeded in bringing about fair improvement in it by terrorising both his officers and the subjects by his severe punishments given to them in case of non-fulfillment of their responsibility.

Primary objectives of Ala-ud-din were to increase the income of the state and root out possibilities of revolts. By implementing the revenue policy, he succeeded in fulfilling his objectives.

Military Administration of Ala ud din Khilji

Ala -ud -din Khilji realised the importance of a strong military administrative system in order to establish a highly centralised and despotic government and an extensive empire in India. He fulfilled the necessity by keeping a permanent standing army at the capital.

Ala -ud -din Khilji realised the importance of a strong military administrative system in order to establish a highly centralised and despotic government and an extensive empire in India. He fulfilled the necessity by keeping a permanent standing army at the capital.

The army of Ala -ud -din Khilji was recruited, equipped, trained and paid by the center. The army minister directly recruited the soldiers of the sultan`s army. The soldiers were supplied with horses, arms etc. by the state and were paid in cash by the royal treasury. The soldier with one horse was paid two hundred thirty four Tankas for a year while a soldier with two horses was paid seventy eight Tankas more. The sultan`s army consisted of 4, 75,000 cavalrymen. War elephants also constituted an important part of the army. Swords, bows and arrows, mace, battle axe, dagger were important arms used by the soldiers. Stone-throwing machines were also used in wars.

Ala -ud -din Khilji`s army was based on the Turkish model and divisions of unit units rested on the decimal system. Ala -ud -din also took measures to stop the corrupt practices by the soldiers which were reducing the effective strength of the army. He instituted the practice of recording the huliya (descriptive roll) of individual soldiers and that of Dagh (branding of horses). The Diwan - i -Arz kept the record of all of them. Besides a strict review of the army was occasionally made and horses and arms of soldiers were thoroughly examined.

Ala -ud -din repaired the forts constructed by Sultan Balban on the north-west frontiers. He also constructed new forts there and other places also like Kampil, Patiali and Bhojpur. Soldiers were permanently in these forts and arrangements were made for regular supply of arms to them. Grain and fodder always remained stored in these forts. Thus, all forts were always kept prepared for all eventualities in case of any invasion.

During his reign, larger part of northern India was conquered, all rulers of south India were defeated and all Mongol invasions were successfully repulsed. This proves that had Ala -ud -din Khilji succeeded in building up a strong army.

Conflict between Mongols and Ala-ud-din Khilji

Ala-ud-din Khilji, the second ruler of the Khiliji Dynasty, attacked the Mongol Empire in 1299. The Khilji army led by Zafar Khan easily defeated the Mongols and forced them to retreat. Zafar Khan pursued them but Mongol general Qutlugh Khwaja played a trick on him where he was surrounded by the Mongols and was eventually killed. Ala-ud-din Khilji however, continued his attacks on them that drove them away to the place from where they had descended.

Ala-ud-din Khilji, the second ruler of the Khiliji Dynasty, attacked the Mongol Empire in 1299. The Khilji army led by Zafar Khan easily defeated the Mongols and forced them to retreat. Zafar Khan pursued them but Mongol general Qutlugh Khwaja played a trick on him where he was surrounded by the Mongols and was eventually killed. Ala-ud-din Khilji however, continued his attacks on them that drove them away to the place from where they had descended.

It took a long time for the Mongols to re-organise themselves and prepare for an attack. They waged a war on Ala-ud-din Khilji at a time when the later was engaged in besieging Chittor. With an army of almost 12,000 under the leadership of Targhi, the Mongols travelled to Delhi and made a surprise attack. The governors could hardly restrain their attack and could not even send their forces in time. The series of invasion forced Ala-ud-din to withdraw to Siri for almost two months. In the meanwhile the Mongols invaded and plundered Delhi and its surrounding areas.

Ala-ud-din Khilji still had the Siri Fort under his possession. He fortified his forts along the borders and equipped them with a strong force. Besides this, new fortifications were also constructed for protection of the area. New forces led by special governors were formed with the aim to guard the border areas. However, these strong measures could not hold back the Mongol army. The forces under the headship of Ali Beg and Tartaq intruded into the premises of Punjab as well as in the neighbourhood of Amroha. They completely ransacked Punjab and destroyed everything on their way.

Ala-ud-din Khilji nonetheless, did not give up in this mission. He soon formed a strong army under Ghazi Malik and the famous Malik Kafur, his two tough generals and sent them to fight the invaders. The Khilji forces made a surprise attack on the Mongols and in the Battle of Amroha captured Kubak and other Mongol generals. They were produced in front of Ala-ud-din Khilji who had them trampled by elephants. The heads of other Mongol prisoners, who were put to death, were hung on the fort walls.

The Mongols with their left forces under the leadership of Kebek marched towards Himalaya Mountains crossing the Indus River near Multan. They were seized by Ghazi Malik, the governor of Punjab who also captured almost 50,000 Mongols including a general of the Mongol army. By order of Ala-ud-din Khilji they were all put to death.

In 1307-1308 the last Mongol invasion of the period took place under the leadership of Iqbalmand and Tai Bu. The forces were on the verge of crossing the Indus Valley when they were captured by the Khiljis and killed. After the death of Duwa, the Mongol Khan, the clash over the succession subdued the flurry of Mongol raids in India.

Ala-ud-din Khilji, known to be an efficient strategist effectively planned his actions and sent a strong army under the expert general Ghazi Malik to Ghazni, Kandhar and Kabul. The series of attacks completely destroyed the Mongol army heading towards India. The Khilji also took Warangal, Siwana and Jalor into their possession. The army now under Commander Malik Kafur attacked Malababar from Devagiri in 1311 and amassed huge wealth. The Khilji king soon got a hint that the Mongol captives who were converted to Islam at the order of the King were planning a secret attack on him. He thus, had almost 20,000 arrested and put to sword. The court of Delhi is also said to have killed the emissaries of Oljeitu.

The Mongols next attacked when the Tughluq Dynasty had overpowered the Khiljis. The Chagatai Mongols in 1327 annexed the frontier towns of Lamghan and Multan under the leadership of Tarmashirin. The Tughlaq ruler in order to safeguard his dynasty paid a huge amount to the Mongols. Further no other large scale Mongol attacks took place in India excepting small Mongol forces waging wars on the local powers in the north western region.

Conquest of Ala-ud-din Khilji

Ala-ud-din was a very ambitious and a shrewd warrior. To materialize his vision to rule most territories of the country, he set out a conquest. During his conquest he looted many states in the north. His strong support during his conquest were his brother Ulugh Khan, Nusrat Khan, Zafar Khan and his brother-in-law, Alp Khan.

Ala-ud-din was a very ambitious and a shrewd warrior. To materialize his vision to rule most territories of the country, he set out a conquest. During his conquest he looted many states in the north. His strong support during his conquest were his brother Ulugh Khan, Nusrat Khan, Zafar Khan and his brother-in-law, Alp Khan.

In 1297, Ala-ud-Din sent a huge army under the command of Ulugh Khan and Nusrat Khan to conquer Gujarat. Rai Karan Dev second was the ruler of Gujarat. He fought for sometimes and then ran away. Ala-ud-Din`s army captured the capital Anhilwara. The beautiful queen of Karan Dev second was made prisoner. She was taken away to Delhi. Ala-ud-Din married her. Ala-ud-Din`s army plundered Gujarat and took away a large amount of booty. But, the greatest prize of all bagged in `Hazar Dinari` slave, Malik Kafur, who became the prime minister of the King later.

Alauddin`s second conquest was Ranthambhor a very famous fort of Rajputana. Qutb-ud-Din and Iltutmish conquered it, but now it was being ruled by a Rajput king, Hamir Dev. In 1299, Ala-ud-Din sent an army under Ulugh Khan and Nusrat Khan to capture the fort of Ranthambhor, but the Rajputs defeated them. Even Nusrat Khan was killed in the battlefield. When Ala-ud-Din heard of this, he personally proceeded against Ranthambhor in 1301. The Rajputs fought bravely. It took a few months to capture Ranthambhor.

The most famous conquest in the Khilijian history was the conquest of Chittor by Ala-ud-din. The King of Chittor ,Rana Bhim Singh was captivated on Monday, Aug. 26, 1303 and Chittor fell. Thousands of Rajput women with Rani Padmini inside had entered a cellar and burnt themselves to ashes preferring a fiery death and unsullied honor to the lecherous hell of Islamic torture and venery. Discomfited Alauddin in impotent anger massacred thousands of children and old men found in the fort. In 1305 Alauddin Khilji captured Malwa and annexed Ujjain, Mandu, Dhar and Chanderi. Alauddin Khilji`s expedition to Bengal was not successful and it remained independent.

The next in line for Ala-ud-din`s conquest was Malwa which was under the rule of Rai Mahlak Dev. In 1305, Ala-ud-Din Khilji sent an army to Malwa under Ain-ul-Mulk Multani. The Rajput King Rai Mahlak Dev opposed the invaders, but he was killed in the battlefield. This victory helped the Delhi Army to occupy Ujjain, Mandu, Dhar and Chanderi. By the end of 1306 A.D. practically the whole of Northern India came into the hands of Ala-ud-Din.

Now, Ala-ud-Din directed his attention towards the conquest of the South. He was the first Muslim king, who tried to invade the South. After the North had been brought under his control, it was natural for Ala-ud-Din to try for the extension of his influence over the South. Ram Chandra Deva was the king of Devgiri. He gave refuge to Rai Karan Dev second, the fugitive ruler of Gujarat. Rai Karan Dev second made arrangements to marry Deval Devi, his daughter, to a Prince named Shankar. Shankar was the eldest son of Ram Chandra Deva, the King of Devgiri. At that time, there were four main kingdoms in the South, Devgir, Telangana, Hoysala and Pandya kingdom.

In 1307, Ala-ud-Din sent an expedition against Devgiri under Malik Kafur, a slave. The King Ram Chandra Deva was defeated and was brought to Delhi. Ala-ud-Din treated Ram Chandra Deva with all honours. He even gave him a royal canopy and the style of King of kings. Ram Chandra Deva continued to rule Devgiri As a vassal of Ala-ud-Din Khilji. The daughter of Kamla Devi, Deval Devi also was sent to Delhi, where she was married to Khizar Khan, son of Ala-ud-Din. Kamla Devi already was a wife of Ala-ud-Din.

In 1310, Ala-ud-Din`s army under Malik Kafur besieged Warangal, the capital of Telangana. Ram Chandra Deva of Devgiri gave all assistance to Malik Kafur. The King of Telangana, Pratap Rudra Deva was sued for peace. He gave Kafur 100 elephants, 7,000 horses and large quantities of jewels and coined money. He also agreed to send tribute to Delhi every year. Then Malik Kafur was sent to Dwarsamudra, the capital of King Vir Vallabh, the Hoysala ruler. Vir Vallabh was defeated and made prisoner. The rich temples of the city were plundered and Malik Kafur got a lot of gold, silver, jewel and pearls from these temples. Vir Vallabh was brought to Delhi. Later, he could rule over Dwarsamudra only as a vassal of Delhi.

From Dwarsamudra, Malik Kafur marched towards Madura. Madura was the capital of Pandya Kingdom. Vir Pandya, the King of Madura abandoned his capital and ran away with his queens. Malik Kafur plundered the city. The main temple was destroyed and a mosque was built there. He got many elephants, 20,000 horses, 2,750 pounds of gold and lots of jewels. No such treasure had been brought to Delhi ever before. In 1312, Malik Kafur attacked Devgiri again, because Shankar Deva, the successor of Ram Chandra, withheld the tribute promised by his father and tried to regain his independence. Shankar Deva was killed. His kingdom was captured.

Tomb of Ala-ud-din Khilji

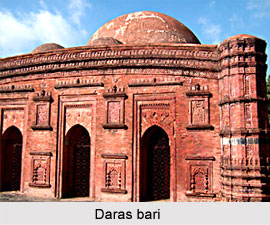

On the southwest side of the Qutub Minar court, stands an L-shaped construction, consisting of Ala-ud-din Khilji`s tomb dating CA 1316 AD, and a Madrasa, an Islamic seminary built by him. It was marked originally by a boldly projecting portico, the remains of which still exist. Khilji was the second Sultan of Delhi from Khilji dynasty, who ruled from 1296 to 1316 AD.

Structure of Khilji"s Tomb

The central room of the building, where the tomb lies, has now lost its dome, though many rooms of the seminary or college are intact because of recent restoration. There were two small chambers connected to the tomb by passages on either side. Fergusson in his book suggested the existence of seven rooms, to the west of the tomb, two of which had domes and windows. The remains of the tomb building suggest that there was an open courtyard on the south and west sides of the tomb building, and one room in the north side served as an entrance.

Concept of Madrasa and Tomb

The concept of a combined Madrasa and tomb, probably a Saljuqian tradition, makes its first appearance in India here. The Alai Minar stands near to the tomb, an ambitious tower, which Ala-ud-din Khilji started to construct to rival the Qutub Minar, though he died when only its first storey was built and then its construction got abandoned. It now stands, north of the mosque.

The tomb is in a very decayed condition. It is believed that Sultan Ala-ud-din`s body was brought to the complex from Siri and buried in front of the mosque. Later it became a part of the Madrasa adjoining the tomb. Firoz Shah Tughluq, who took on the responsibility to repair the tomb complex, mentioned a mosque within the Madrasa.