Revenue Collection has been included in the VI chapter of Book II, under the Duties of Superintendents, in Arthashastra. Kautilya listed at eight regular sources of collection of revenue which shall remain the same at all conditions, while there had been other sources of collection of revenue which includes even the royal family as well. Kautilya fixes the responsibility of tax collection on a particular officer whom he calls collector general who shall visit through out the length and breathe of the country to verify the collection and make a correct estimate of the net tax to be collected and has been collected at the end.

Permanent Sources of Revenue Collection

Revenue Collection had been an ancient source of earning income for the state from the entire movable as well as immovable property of the state. In Arthashastra, Kautilya makes full provision for such income. For the collection of revenue the Collector general shall attend to forts, country side, mines, buildings, garderns, forests and herds of cattle and roads of traffic. Tolls, fines, weights and measures, the town-clerk (nagaraka), the superintendent of coinage (lakshanadhyakshah), the superintendent of seals and passports, liquor, slaughter of animals, threads, oils, ghee, sugar (kshara), the state goldsmith (sauvarnika), the warehouse of merchandise, the prostitute, gambling, building sites (vastuka), the corporation of artisans and handicrafts men (karusilpiganah), the superintendents of gods, and taxes collected at the gates and from the people (known as) Bahirikas come under the head of forts. Taxes can also be collected from produce from crown lands (sita), portion of produce payable to the government (bhaga), religious taxes (bali), taxes paid in money (kara), merchants, the superintendent of rivers, ferries, boats, and ships, towns, pasture grounds, road-cess (vartani), ropes (rajah), and ropes to bind thieves (chorarajah) come under the head of country parts.

Revenue from Other Sources

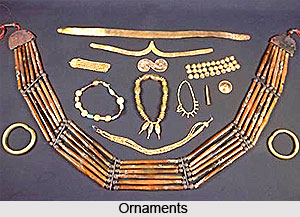

Revenue collection along with the mentioned can further be collected from other sources of income which includes the precious assets like gold, silver, diamonds, gems, pearls, corals, conch shells, metals (loha), salt, and other minerals extracted from plains and mountain slopes which come under the head of mines. Other sources include the flower gardens, vegetable gardens, fruit garden, wet land, wet fields and fields where crops are grown by sowing seeds that come under Setu; game forests, timber forests, elephant forests fall under the forest category; cows, buffaloes, goats, mules, sheep, camels, horses, and assess come under the categories of herds who shall be included in paying taxes. Land and water ways are the roads of traffic from where the amount of taxes is fixed.

Categorical Division of Groups

Revenue is further collected through the chanting of auspicious hymns during the worship of gods and ancestors, and on the occasion of giving gifts, the harem, the kitchen, the establishment of messengers, the storehouses, the armoury, the warehouse, the store-house of raw materials, manufactories (karmanta), free labourers (vishti), maintenance of infantry, cavalry, chariots, and elephants, herds of cows, the museum of beasts, deer, birds and snakes and storage of firewood and fodder which constitute the body of the expenditure (vyayasariram).

Forms of tax collection and division of time

Taxes can be collected in a number of forms where taxes can be collected in the form of capital (mula ), shares ( bhaga), premia( vyaji ), parigha, fixed taxes( klrpta ), premia of coins(rupika) and fixed fines (ataya ) and several forms of revenue at the mouth from which income is to be issued. Collection of revenue has been divided through out the year within the rainy season, winter season and summers which has further divided the work according to the royal year, month ( paksha ), day, New Year`s Day or Sravana in which the third and the seventh paksha which includes the rainy season, winter, and summer will fall short of one day, the rest complete and the separate intercalary month are the division of time.

Job of Collector General

Revenue collection also includes the job of the collector who has to attend to the work in hand; work accomplished; part of work in hand and receipts, expenditure and net balance`s work in hand specifies business of up keeping the government records, routine work collection of necessaries of life, collection and audit of all kinds of revenue. The collector general then makes an estimate of expenditure which are of two types - daily expenditure and profitable expenditure which includes all the spending of the state. Whatever remains after making the expenditures and after excluding the taxes is called the net balance which has been either just realized or just brought forward.

Thus, revenue collection includes both the sources from which the state would earn some assets as well as the role of the collector general who is in charge of collection of royal revenue for the king.