British system of land revenue in India can blindly be accredited to the Permanent Settlement Act of 1793, formulated by the then Governor General of India, Lord Cornwallis. After the advent of the British to the country, India was still being ruled and strictly administered under the Mughal system of money-making. With Islamic rule still dominating the governing scenario, the arrival of the British was looked at as almost a cultural and administrative shock. The very English style of living, administering and imposing of rules by the East India Company in the early years of 17th century, was yet far far away from the yet to come Ryotwari System, Zamindari System or Mahalwari system. Initially, the imperialists had circulated the idea of common Indian compassion and kindness towards the native farmers in the agrarian economy. India back then essentially served as a nation entirely based upon farming and cultivation of lands and crops. However, with the introduction of British land revenue system in India, the farmers had cope with an entirely new merciless side of colonial rule.

British system of land revenue in India can blindly be accredited to the Permanent Settlement Act of 1793, formulated by the then Governor General of India, Lord Cornwallis. After the advent of the British to the country, India was still being ruled and strictly administered under the Mughal system of money-making. With Islamic rule still dominating the governing scenario, the arrival of the British was looked at as almost a cultural and administrative shock. The very English style of living, administering and imposing of rules by the East India Company in the early years of 17th century, was yet far far away from the yet to come Ryotwari System, Zamindari System or Mahalwari system. Initially, the imperialists had circulated the idea of common Indian compassion and kindness towards the native farmers in the agrarian economy. India back then essentially served as a nation entirely based upon farming and cultivation of lands and crops. However, with the introduction of British land revenue system in India, the farmers had cope with an entirely new merciless side of colonial rule.

Land revenue in India during British times were primarily based upon the mode of money collection by the tax farmers, who in turn would receive this money from the local land owners (or termed as zamindars). In such a process of intermediary, the poor and helpless farmers remained absolutely exploited, with maximum of the moolah going to British tax farmers and the zamindars, as denominated by the British. After such hard work and toil in the fields for day and night, the only thing they received in turn were floggings and caustic comments from the lord class. The British land revenue system in India had shattered and devastated the native agrarians from the core psyche, with practically nothing left for them to call their own. The rules were always set leaning towards the benefit and relaxation of the higher strata of the society with zamindars and English demanding the most. Lord Cornwallis`s Permanent Settlement Act had tried to do some bit of amending, which again was thrown to plundering by Governor General Warren Hastings and his five-yearly inspections and collection of revenue.

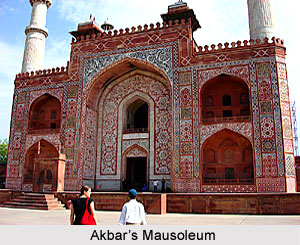

British domination and authority over Indian soil commenced during the seventeenth century and by the end of that century colonial rule had expanded over wide areas with the fall of Mughal Empire, crushing of the Maratha rule and political overthrow of local powers. The British, as such effortlessly had inherited the `institutional form of agrarian system` from the Mughals. The rulers then had blindly overlaid a system over the still active pattern, in tune with strict British customs and laws associated with land. Such desperate actions on the part of such shrewd English administers did not go down well with the East India Company rulers, who practically had been usurping priceless native funds. As such, British system of land revenue in India was hugely criticised in England, with the Company suffering a crushing defeat. Largely, three basic kinds of land revenue system were introduced during British India. The fundamental feature of each of these systems was the challenge to integrate elements of the antedating agrarian construction. The interface of this colonial policy and the existing systems, gave rise to grossly dissimilar local results and hybrid forms. It is fascinating to note that the techniques employed in land revenue in various parts of India remain largely unaltered even today since their initiation by Raja Todarmal during the reign of Mughal emperor Akbar.

Various kinds of land revenue systems were ushered in, in various part of British India, as the British annexed parts of India in succeeding periods. These land revenue systems comprised: . Zamindari system, Rywotari System and, Mahalwari System.